A Sober Assessment of Offsets, Credits, and Accountability

By Amb. Canon Otto

Convener, Global Sustainability Summit

Contributor, SustainabilityUnscripted

For more than two decades, carbon markets have been presented as one of the most elegant tools in climate policy: put a price on pollution, reward reductions, and let markets do what they do best—allocate capital efficiently.

In theory, it is a pragmatic solution. In practice, it is time we asked a more uncomfortable question:

Are carbon markets actually helping the climate—or are they helping us delay real change?

At CleanCyclers, and through ongoing debates on SustainabilityUnscripted, we see carbon markets not as inherently flawed—but as dangerously over-relied upon in a world that needs faster, deeper, and more systemic transformation.

The Promise of Carbon Markets

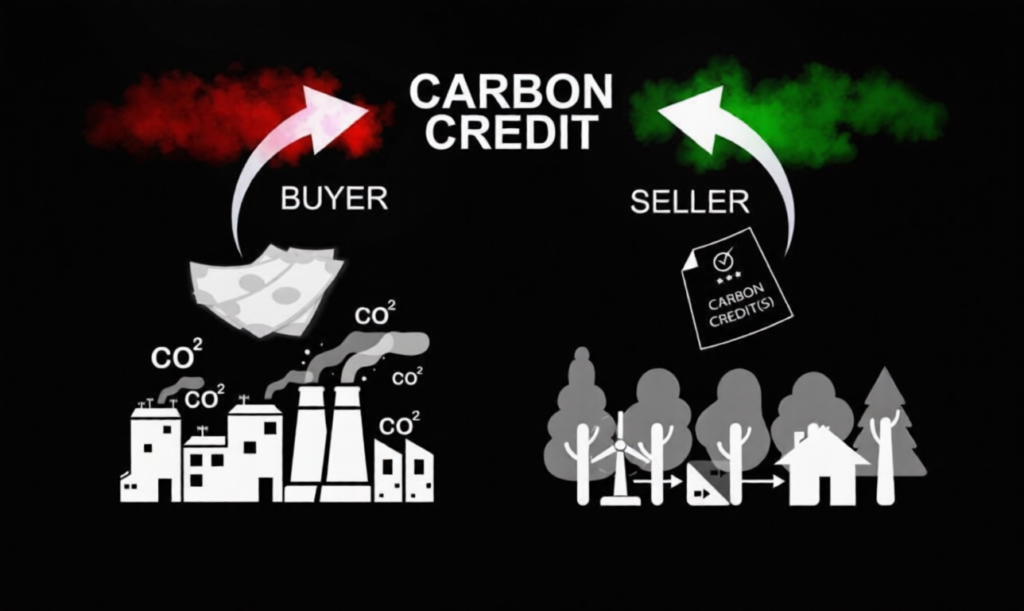

The original idea was simple:

If emissions have a cost, businesses will innovate to reduce them.

If reductions can be verified, they can be traded.

If capital flows to the cheapest reductions, global emissions fall faster.

This logic helped mainstream climate finance and brought private capital into the transition. That is not nothing. Carbon markets helped make climate a boardroom issue, not just an environmental one.

But climate change is not a normal market failure. It is a systems failure. And systems failures do not yield easily to accounting instruments alone.

The Offset Illusion

Offsets sit at the heart of today’s carbon markets—and also at the heart of their credibility crisis.

In principle, an offset represents a real, additional, permanent reduction or removal of emissions. In reality, many offsets struggle with:

- Additionality: Would this project have happened anyway?

- Permanence: Will the carbon stay stored for decades—or be released next year?

- Verification: Are the claimed reductions real, measurable, and enforceable?

- Leakage: Does reducing emissions in one place simply shift them somewhere else?

When these questions are not answered rigorously, offsets become storytelling devices rather than climate solutions.

The danger is not just technical. It is moral and strategic. Offsets can create the comforting illusion that we are “balancing” our impact, while structural emissions remain untouched.

Through SustainabilityUnscripted, we have consistently warned that credibility, not convenience, must define climate action.

When Accounting Replaces Transformation

One of the most troubling trends in climate strategy is the substitution of accounting creativity for system redesign.

It is easier to buy credits than to:

- Rethink supply chains

- Redesign products

- Rebuild infrastructure

- Change materials and processes

- Invest in circular systems

At CleanCyclers, we see this tension clearly in the waste and materials economy. You cannot offset a broken waste system into sustainability. You must redesign it.

A landfill does not become circular because emissions were compensated elsewhere.

A polluted river does not become clean because a credit was purchased.

A linear economy does not become resilient through certificates.

Carbon markets were meant to support transition—not replace it.

The Accountability Gap

Another critical weakness is accountability.

Who is responsible when an offset project fails?

Who audits long-term outcomes, not just short-term claims?

Who ensures that credits represent real climate value over decades, not just reporting cycles?

Too often, the carbon market rewards transaction volume more than climate integrity. The result is a system where:

- Buyers optimise for low-cost credits

- Sellers optimise for scale and speed

- The climate optimises for nothing at all

As Convener of the Global Sustainability Summit, I have seen growing consensus among serious climate leaders: markets without trust, transparency, and enforcement do not deliver public good.

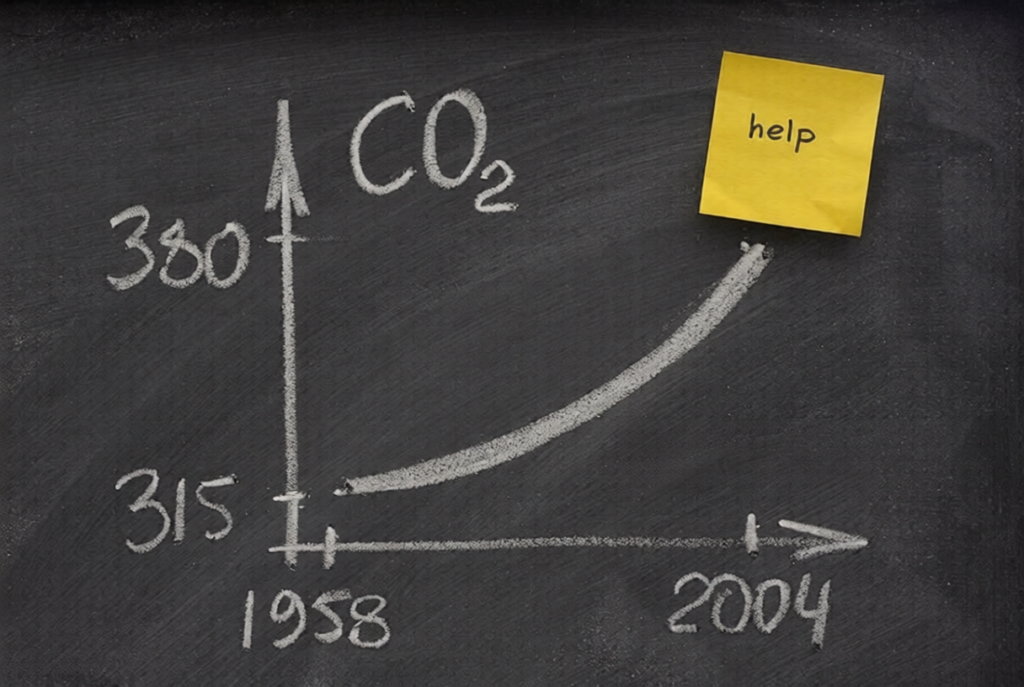

The Risk of Delayed Reality

Perhaps the greatest danger of poorly governed carbon markets is not that they fail completely—but that they succeed at delaying the inevitable.

Every year spent offsetting instead of transforming is a year in which:

- High-emission assets remain in place

- Fragile systems stay fragile

- Vulnerable communities stay exposed

- Real resilience is postponed

Climate physics does not negotiate with accounting frameworks.

The atmosphere does not care whether a reduction happened on paper or in reality.

Where CleanCyclers’ Perspective Matters

At CleanCyclers, we work at the level of materials, systems, and infrastructure—where emissions are actually produced or prevented.

Waste, resource loss, and pollution are not abstract externalities. They are design outcomes. And design outcomes cannot be fixed by certificates alone.

Circular systems reduce emissions at the source.

Efficient material recovery prevents future pollution.

Resilient infrastructure lowers long-term risk.

These are structural solutions, not compensatory ones.

Carbon markets, if they are to remain relevant, must increasingly reward this kind of systemic change—not just lowest-cost avoidance elsewhere.

So, Are Carbon Markets Failing?

The honest answer is: they are underperforming the moment they are most needed.

They are not useless. But they are not sufficient.

They are not the transition. They are, at best, a tool within it.

Without:

- Much stricter standards

- Radical transparency

- Long-term accountability

- And a clear hierarchy that puts real reductions before offsets

…carbon markets risk becoming a sophisticated distraction in a decade that demands structural courage.

The Real Test of Climate Leadership

The real test is not whether an organisation can claim “net zero.”

It is whether it is actually changing how it produces, consumes, and designs systems.

Through CanonOtto’s work at the Global Sustainability Summit, and through the critical lens of SustainabilityUnscripted, one message is becoming unavoidable:

We cannot trade our way out of a system we refuse to change.

Carbon markets should serve transformation—not substitute for it.

And the climate will ultimately judge us not by the elegance of our frameworks, but by the reality of our results.